The industrial real estate market has proved to be one of the more resilient major commercial property types, both during and after the pandemic. Inflation-adjusted retail goods sales and truck tonnage are at high levels, and containerized imports at U.S. seaports are posting seasonally adjusted all-time highs. The T-12 figure of 12.6 percent rent growth in 2022 remains near the record highs of sector, however, the pace of recent quarterly gains has been moderating.

The U.S. industrial market is positioned for another strong year in 2023 even after relentless record-level demand for warehouse-and-distribution space in 2022. However, the landscape is moderating in terms of demand, new supply and sales volume given general economic uncertainty and multiple interest rate hikes by the Fed over the past 18 months. As capital have become more expensive and scarcer, industrial construction starts and sales volume have slowed but rent growth remains strong and vacancies stable.

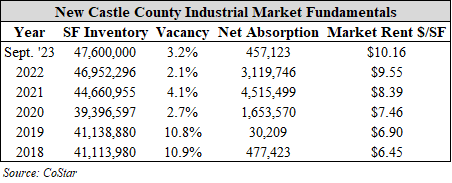

We researched industrial market fundamentals for New Castle County, Delaware. In terms of supply, CoStar tracks total county industrial space inventory of about 47.6 million square feet in 1,134 buildings. As of September 2023, the local industrial market was operating at a 3.19 percent vacancy rate – about a third of the long-term 10-year average of 9.45 percent.

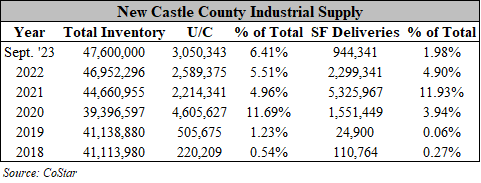

In terms of supply, since 2020 the county has added 10.12 million square feet of industrial space while its overall vacancy rate has remained stable at 2.1 to 4.1 percent. With a lack of bigger logistic warehouse buildings, new construction of 500,000+ square foot buildings grew by 2.16 million square feet over the past three years. Correspondingly, given the demand for big-box distribution warehouse space, the vacancy rate for this building size sector has declined from 9.6 percent to 1.5 percent.

In conclusion, historical tenant demand, measured by net absorption, has outstripped supply. Positive net absorption in 2022 slowed by 1.4 million square feet. The vacancy rate has dropped from 10.9 percent five years ago to 3.2 percent currently. The reported average rent in the county has grown by 9.5 percent annually from 2018s average asking rent of $6.45 to the current asking rent $10.16 per square foot. Given this strong tenant demand industrial asking rents have grown by over 10 percent annual compound over the past four years. The outlook is for rent growth to begin to moderate as drivers of warehouse space demand like retailer cutting inventory growth, import/export shipments decline, and new supply is added. Although tenant demand has been slowing, the industrial market is not out of balance nor in risk of being over-supplied. The feasibility of new construction starts are being impacted by capital market disruptions and the expense of debt/equity. Landlords likely will continue to drive rent growth upward as market activity normalizes back to pre-pandemic 2019 levels.