The national office vacancy was 20.5 percent as of Q2 2023 according to JLL. The office sector is facing persistent challenges associated primarily with the work from home movement and functional obsolescence. The remote or hybrid work model has caused a structural change in the way tenants view and utilize their space needs. The office market will contract as tenant leases roll over into smaller spaces.

Still, office real estate carries a certain social value needed by many companies and their employees. This includes tangible connections for teamwork/ collaboration, shared experiences, learning and mentoring that the physical office environment provides better than the remote and hybrid models.

The Nareit All Equity REIT Index rose by two percent in July – its second consecutive monthly gain following June’s 5.36 percent rise. The much-maligned office REITs led the July index with a 13.32 percent gain in total returns, but total returns for the year have been -5.01 percent.

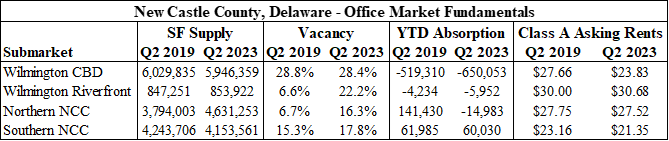

Since real estate is local, we have also looked at current New Castle County office market stats vs. pre-pandemic office market fundamentals four years ago below. The office CBD vacancy rate remains elevated, continues to churn negative net absorption and the asking rent has essentially remained flat. All four submarkets have elevated vacancy rates and asking rents in the suburbs has declined.

With tenants cutting space needs, moving to better quality buildings, and the advancement of artificial intelligence, the outlook for the sector over the next few years is somewhat grim. As space demand wanes, building vacancy rates will increase forcing old, obsolete buildings to be mothballed, converted to alternative uses, or demolished. Defaulted and maturing office loans unfortunately will also feed the distressed asset fire.

For lenders, the office market has been deemed a ‘no-fly zone’ due to the drastically reduced the demand for office real estate. The hybrid work structure has shaken up the national office market with negative absorption. When combined with new office construction deliveries and a flight to quality by many tenants, vacancy rates have been increasing as well. Higher vacancy rates, lower net effective rents, higher inflationary operating costs, and functional obsolescence have caused many buildings to be challenged for continued office use.

As tenants resize their office footprints and leases expire, it will take time for the market to reset. C&W estimates that the U.S. workforce will only require 4.61 billion square feet of office space at the end of the decade, assuming office-using employment grows by 6 percent over that period. If realized, the 1.1 billion-square-foot glut of excess office space will represent a 55 percent increase from the amount of obsolete office space in fourth-quarter 2019.

Office conversions to alternative uses seem to be the logical next step with the potential surplus of vacant, obsolete office buildings. Conversion of office buildings to residential uses have been common practice in downtown Wilmington. BPG has recently converted Lincoln Square, Nemours, and 101 DuPont Place into a total of almost 400 apartments and the Westover Companies recently completed the conversion of 901 Market Tower into 82 apartments. There are other alternative uses for office buildings like conversion to life sciences (i.e., CRISP), hospitality (1220 N. Market Staybridge Suites) and education. Depending upon the structure and the extent of renovation necessary conversion costs can range from $250 to $350 per square foot. This makes the balancing act of managing cost and risk very important to ensure the economic feasibility.

Even amid the structural shift in commercial real estate, there will always be a need for commercial office space. The good news is that slowing new space deliveries, accelerated demolitions and conversions of vintage offices and increased leasing activity should help offset the likelihood of rising vacancy. Better quality office buildings will have the ability to better attract and retain tenants and those buildings dealing with cash flow or loan stresses will offer opportunities for redevelopment.